Fintech

Top FinTech Trends for 2023

Introduction

FinTech is one of the fastest-growing industries in the tech world. Also playing an increasingly important role in the future of finance, the combination of emerging technologies and financial accessibility and efficiency that FinTech offers is a must-know for any tech-savvy individual. In this blog, we'll cover the basics of FinTech, seven of the biggest developments we'll see in 2023, and how Scalio can help new and existing FinTech projects.

FinTech Basics and Market Development

FinTech, short for "financial technology," refers to any innovative technologies and business models that are disrupting and transforming the financial industry. FinTech encompasses a variety of financial services, including banking, investment, insurance, and payments, and leverages technology to improve efficiency, accessibility, and user experience.

This innovative market shows no signs of slowing down. For 2023, the predicted value of the FinTech industry is around $165 billion and has seen steady growth from $105 billion in 2021 and $131 billion in 2022. Industry analysts also predict a CAGR of 20% from 2020 to 2030, signaling a massive opportunity for firms to create value by incorporating a financial technology strategy into their product roadmap. Why does FinTech continue to grow steadily despite market fluctuations?

The answer lies in its wide applicability. At its core, FinTech aims to simplify and streamline financial transactions and services by harnessing digital tools and platforms. This includes everything from mobile banking apps and online investment platforms to peer-to-peer lending platforms and blockchain-based payment systems. FinTech companies are often startups or disruptors to traditional financial institutions, and they typically leverage new technologies such as artificial intelligence, machine learning, big data analytics, and blockchain to create innovative financial products and services.

FinTech has become increasingly popular in recent years due to the growing number of mobile devices, rising internet penetration, and the changing preferences of consumers who are looking for faster, more accessible, and more convenient financial services. Fintech has also helped to address the needs of underserved populations, such as the unbanked or underbanked, who may not have access to traditional financial services.

As the financial industry continues to evolve, FinTech is playing an increasingly important role in shaping its future. With the ongoing proliferation of digital devices and the rise of blockchain technology, FinTech is expected to continue to grow and transform the industry in the years to come.

Here are seven high-impact developments that we could see in FinTech in 2023:

Continued Growth in Mobile Payments

One of the biggest trends in FinTech in recent years has been the growth of mobile payments. With the proliferation of smartphones and other mobile devices, more and more consumers are using these devices for payments and transactions. In 2023, we can expect to see this trend continue to grow, with more and more merchants accepting mobile payments and more consumers opting to use their mobile devices for financial transactions.

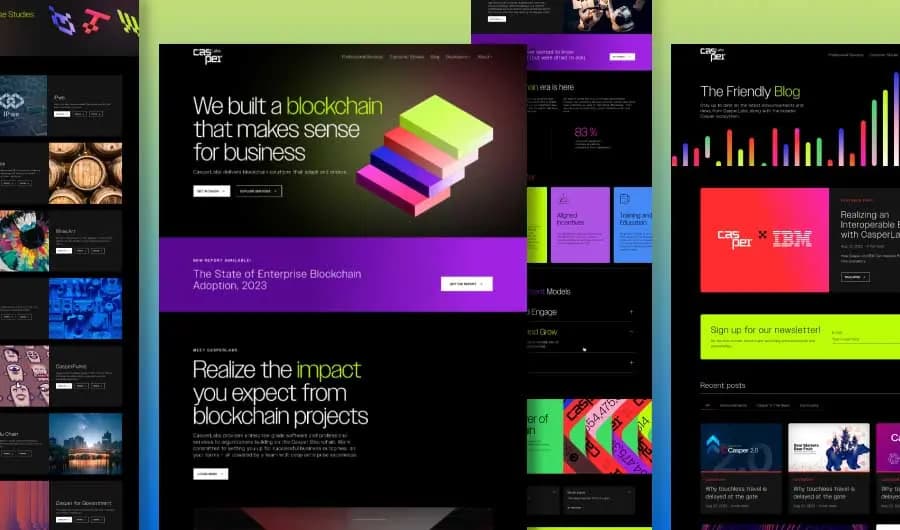

Increased Adoption of Blockchain Technology

Blockchain technology, which underlies cryptocurrencies like Bitcoin, has the potential to revolutionize the financial industry. By providing a secure, decentralized ledger for transactions, blockchain technology can increase transparency and reduce the risk of fraud. In 2023, we can expect to see more and more financial institutions adopting blockchain technology to improve security, efficiency, and transparency.

Advancements in AI and Machine Learning

Artificial intelligence (AI) and machine learning are already being used by FinTech companies to enhance customer experience, improve risk management, and optimize operations. In 2023, we can expect to see these technologies become even more advanced and sophisticated, leading to better outcomes for both consumers and financial institutions.

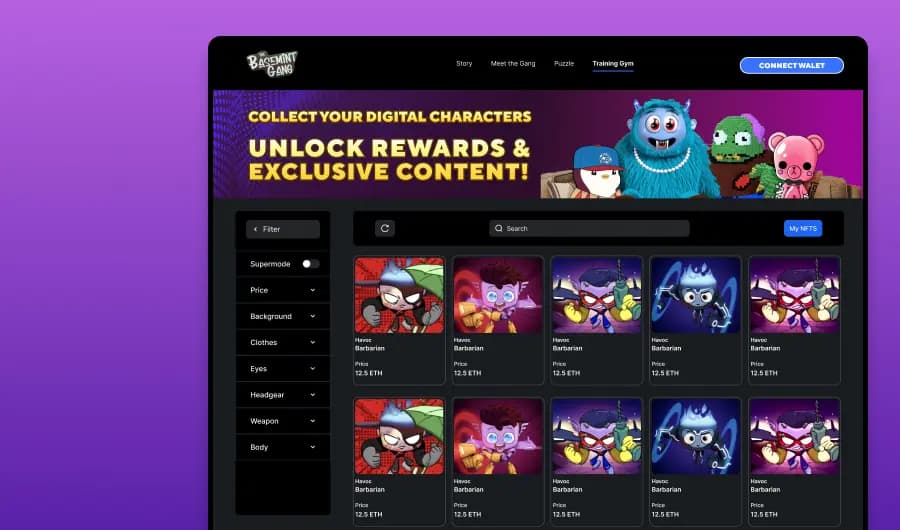

Expansion of Decentralized Finance (DeFi) Platforms

Decentralized finance (DeFi) platforms, which operate on blockchain technology and offer peer-to-peer financial services, have seen explosive growth in recent years. In 2023, we can expect to see these platforms continue to expand, offering a wider range of financial products and services and attracting more investors.

Collaboration between FinTech Companies and Traditional Financial Institutions

While FinTech companies have often been seen as disruptors to traditional financial institutions, we can expect to see more collaboration between the two in 2023. Traditional financial institutions are starting to recognize the potential of FinTech, and are looking for ways to leverage its strengths to better serve their customers. At the same time, FinTech companies are recognizing the value of partnering with established institutions to gain credibility and reach more customers.

Focus on Cybersecurity and Regulatory Compliance

As FinTech continues to grow and evolve, there will be an increasing focus on ensuring the security of financial transactions and compliance with relevant regulations. In 2023, we can expect to see a greater emphasis on cybersecurity and regulatory compliance in FinTech, as companies strive to protect their customers and maintain the trust of regulators.

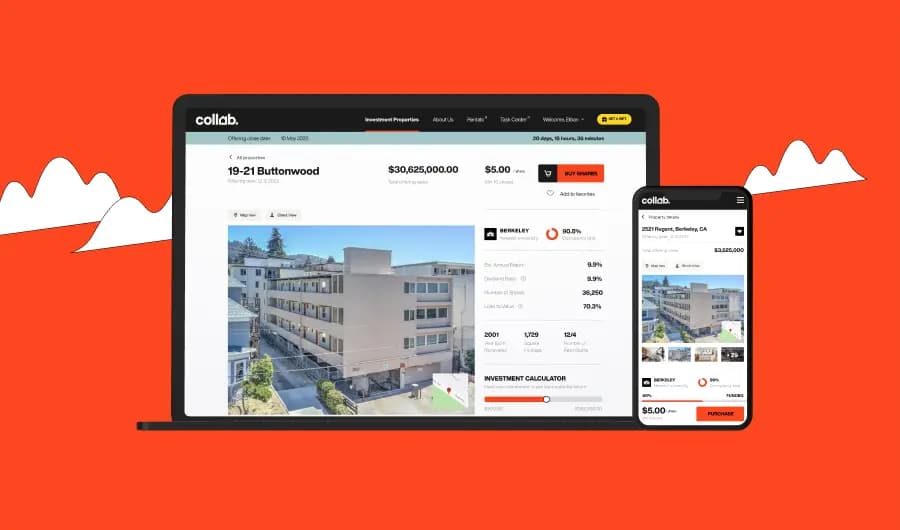

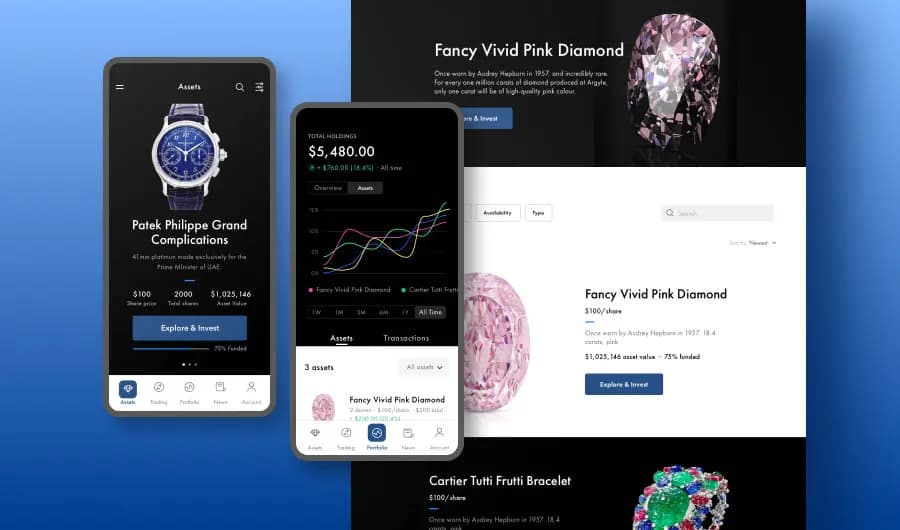

Crowdfunding

Crowdfunding platforms have steadily been gaining popularity in the FinTech industry over the past few years, and this trend is expected to continue well past 2023. These investment platforms provide a way for entrepreneurs, startups, and businesses to raise capital from a large number of individuals, rather than relying on traditional sources of funding like banks or venture capitalists. Value is unlocked and passed onto investors of all backgrounds by exposing asset classes that have historically been inaccessible - from rare collectibles to real estate, art, and even athletes - in much more affordable amounts that may be as low as $50 per share.

For firms seeking a proven investment platform solution, Scalio has built a proprietary product that offers full technological and regulatory support. We offer a time and cost-efficient solution for companies seeking to meet regulatory requirements - one of the most difficult aspects of products utilizing crowdfunding. We have extensive knowledge of the regulatory landscape and an in-depth understanding of verification and purchase flows that have been optimized by hundreds of hours of market research and usability testing.

By utilizing our investment platform solution and expertise, firms can save significant capital while offering assets in a very short turnaround time, and leverage our years of experience in navigating the digital finance and regulatory environment. Schedule a demo by emailing us at hello@scal.io.

Conclusion

FinTech is here to stay. The world of FinTech is constantly evolving, and 2023 is likely to bring many exciting developments in the industry. FinTech has something to offer to almost everyone and is only getting more inclusive, powerful and useful over time.