Fintech

Raising Capital via Equity Crowdfunding

A Five-Minute Guide for Asset Holders

In the current risk-averse capital market environment, it has become increasingly difficult for firms to obtain the capital they need. Meanwhile, investors who are seeking alternative investment opportunities similar to those of the ultra-wealthy have turned to crowdfunding as a solution. As a result, crowdfunding has emerged as one of the go-to options in today's investment landscape. This article explores the benefits of equity crowdfunding for asset holders, the market opportunity, and how asset holders can get started with equity crowdfunding.

In case you’re new to the topic, equity crowdfunding is a type of fundraising that allows companies to raise capital by selling equity (ownership) of assets to a large number of investors through an online platform. In this model, investors are able to invest smaller amounts of money and receive fractional ownership of assets in return.

This approach is especially applicable to alternative assets, which can include:

- Real Estate

- Fine Art

- Rare Collectibles

- Sports Memorabilia

- Estate Jewelry

- Athletes

- Startups & Businesses

- Films, Music, & Intellectual Property

Benefits of Equity Crowdfunding for Asset Holders

Before we get into the market opportunity, let’s explain why it’s as good as it is. There are numerous benefits for both asset holders and investors. For asset holders, here are some of the main reasons to engage in equity crowdfunding:

- Offers access to the high-growth market of alternative assets.

- Provides a cost-effective way to raise capital compared to traditional fundraising methods.

- Platforms offer services to manage investor relations and comply with regulatory requirements.

- Democratizes the investment process, allowing more investors to participate

- Increases the chances of attracting highly-engaged investors

- Provides asset holders with valuable feedback and insights from investors.

With so many benefits for both investors and asset holders, coupled with platforms providing a smooth and user-friendly experience, firms have been raising significant capital via equity crowdfunding. It helps that the market opportunity has never been better.

Tap Into An Unprecedented Market Opportunity

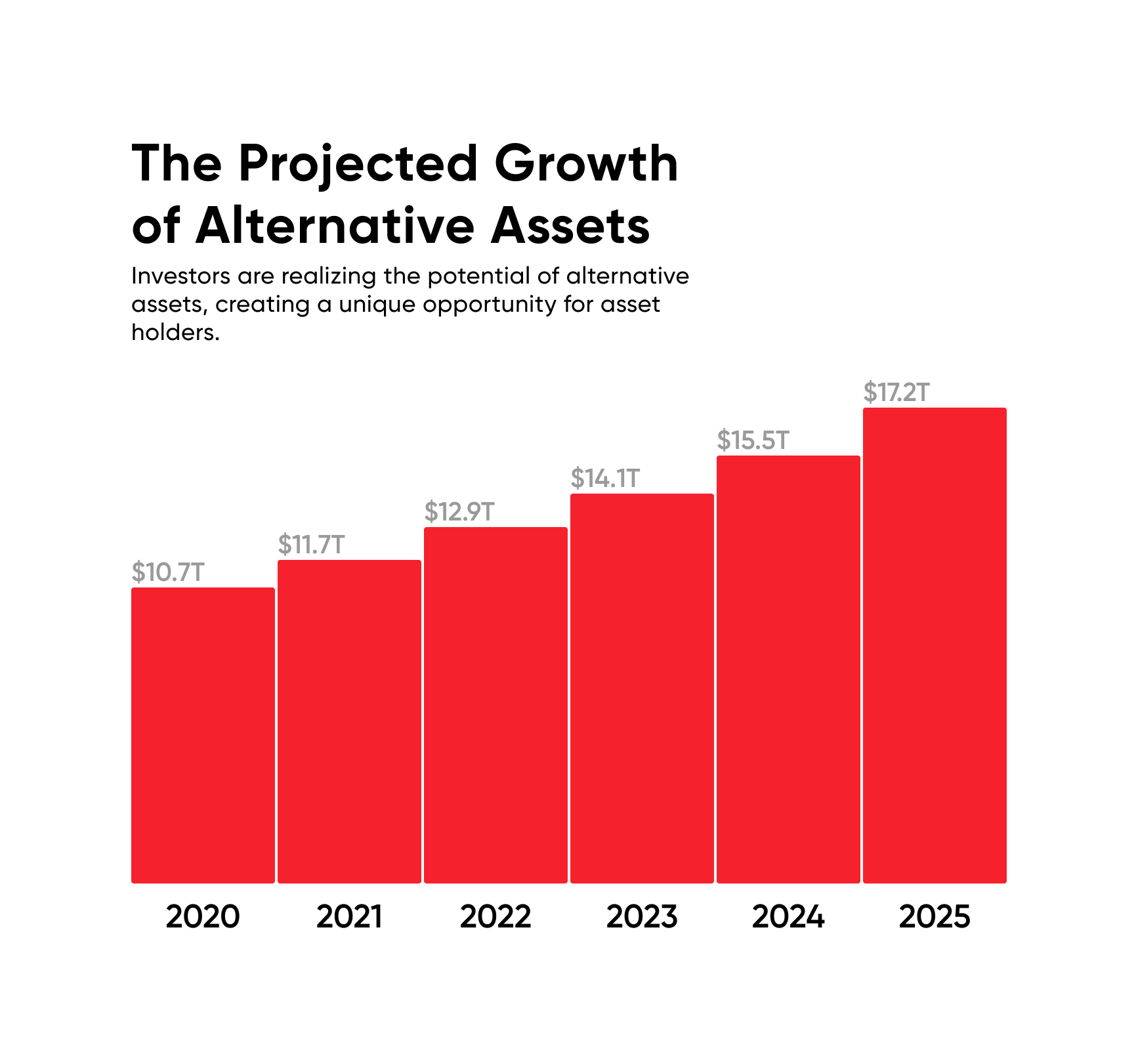

The market is ripe for anyone who holds alternative assets such as real estate, collectibles, fine art, or any other asset type. Regulation A crowdfunding alone raised $52.7 million in March 2023. If you’re unsure about the specifics of Regulation A, D, and CF, you can learn more about it here in our blog.

In another recent report by Kingscrowd, a total of $150.3 million was invested across Regulation Crowdfunding and Regulation A raises in the first quarter of 2023 - a 14.8% growth rate from the first quarter of 2022. This unprecedented growth is corroborated by predictions the global crowdfunding market will reach approximately $17.2 trillion by 2025.

Why Alternative Investments are Becoming More Popular

Investors are increasingly interested in alternative investments, which are typically defined as any investment that falls outside of traditional asset classes like stocks, bonds, and cash. According to a recent article by Yieldstreet, there are several reasons behind this trend.

- Alternative investments offer the potential for higher returns than traditional asset classes.

- They are often less volatile than traditional investments, which can help to mitigate risk.

- Alternative investments provide investors with the opportunity to diversify their portfolios and reduce their overall risk exposure.

- Protection from economic downturns

- They often provide multiple forms of return

- Platforms offer a simplified investing experience

Platforms Offer a Faster Way to Invest

If you are an asset holder, equity crowdfunding provides a more flexible and cost-effective way of raising capital from your assets. Equity crowdfunding platforms offer a streamlined process that is designed to minimize costs and maximize efficiency. These platforms allow asset holders to easily connect assets with investors. In only a few clicks, investors can begin to include alternative assets in their portfolios.

One significant advantage offered by some platforms is SEC compliance. Since the Security and Exchange Commission regulates all equity crowdfunding activities, it can be a significant barrier to raising capital. However, white-label platforms like Particle Capital can assist with maintaining SEC compliance. So keep in mind - when searching for a platform solution, it's essential not only to find a high-quality platform but also to ensure that it provides legal support and SEC compliance.

Getting Started with Equity Crowdfunding

So what can asset holders do to get started? First, identify a reputable equity crowdfunding platform that is suited to your needs. Look for these things:

- SEC (Securities and Exchange Commission) compliance

- Integrations

- Customization for branding and portfolio additions

- Features for scaling (for example, adding more offerings over time)

- Strong track record

- Support for launching marketing campaigns

- Frictionless experience for investors

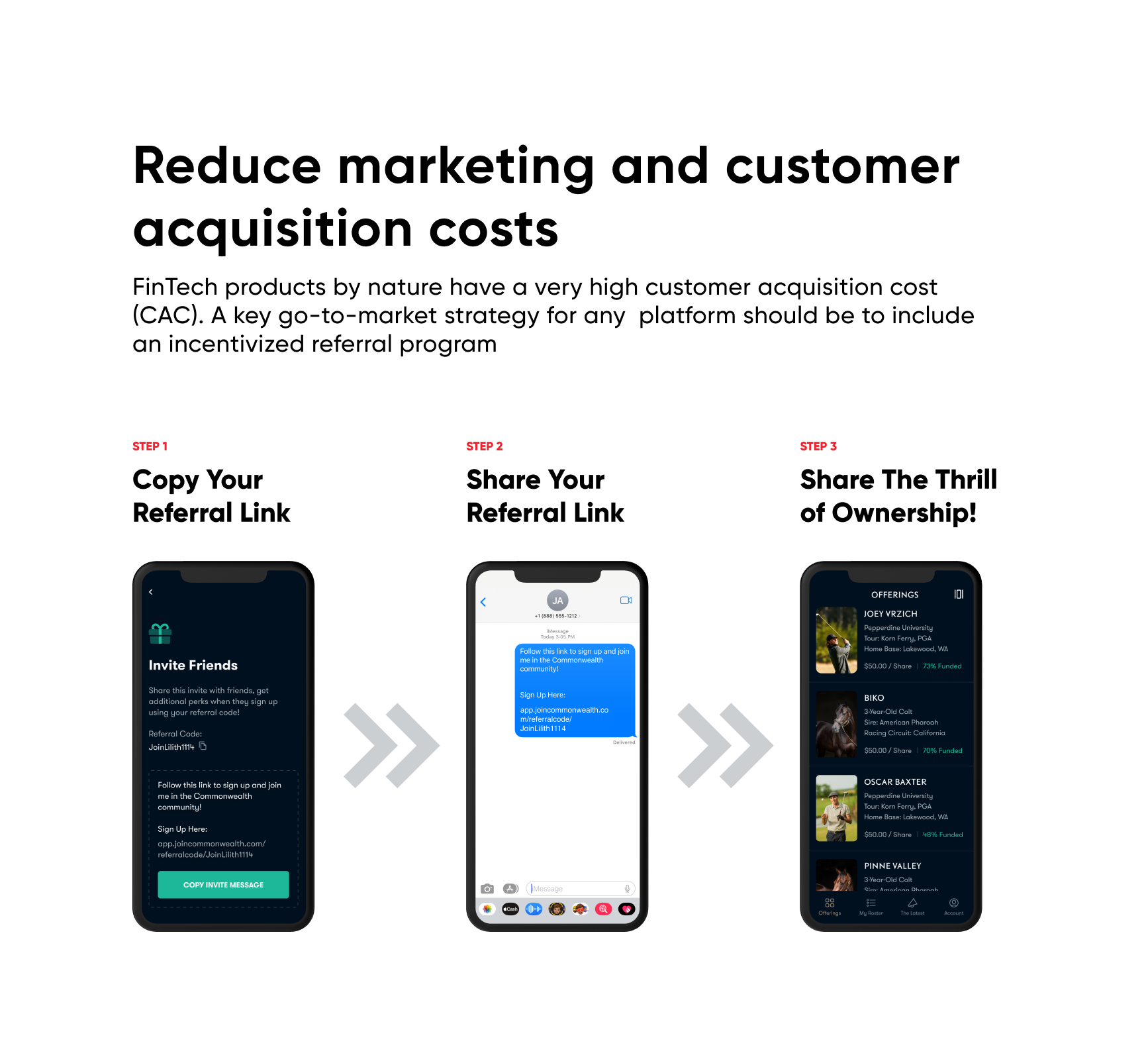

- Prioritize platforms with experience in CAC (customer acquisition cost) reduction

Next, you will need to prepare your campaign materials. This will typically include a pitch deck, a business plan, and any other relevant materials that will help to attract investors to your project.

Once your campaign is live, you will need to actively engage with potential investors and promote your project through various channels. This may include social media, email marketing, and other forms of online outreach.

Conclusion

Equity crowdfunding has emerged as a powerful tool for asset holders who are looking to raise capital in today's risk-averse capital market. By leveraging the power of online investment platforms, asset holders can reach a larger pool of potential investors, build a loyal base of supporters, and raise capital in a flexible and cost-effective way. If you are an asset holder who is looking to raise capital, consider exploring the potential of equity crowdfunding and how it can help you take advantage of a unique market opportunity.